Financial system solutions

1.system overview

Smart finance relies on the Internet technology and USES the financial technology means such as big data, artificial intelligence and cloud computing to comprehensively improve the wisdom of the financial industry in business process, business development and customer service, so as to realize the wisdom of financial products, risk control, customer acquisition and service.Including bank outlets, mobile banking app, WeChat service and other "one-stop, self-service, intelligent" new service experience.The mode of business handling has changed from "teller operation" to "customer autonomy and self-service".

The third-party platform grafts with many traditional banking, insurance, fund, trust and other financial institutions in the industry, conducts detailed analysis on user behavior, market and products, and intelligently recommends diversified investment portfolios for customers.The platform establishes a risk control system driven by data and technology.Establish a comprehensive risk control capability including user data acquisition, real-time computing engine, data mining platform, automatic decision engine and manual auxiliary approval.

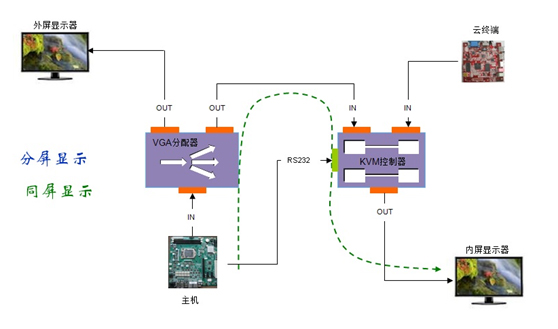

2.System block diagram

3.Application of the system

Smart finance is a more advanced stage in the evolution of traditional financial services in the Internet era.In a smart financial system, it is easier for users to use financial services, and they will no longer be willing to wait for hours at bank branches to save money or borrow money.

Under the smart financial system, users can use financial services more conveniently. After obtaining sufficient information, financial institutions can make immediate response through statistical analysis and decision making of big data engine, and provide users with targeted services to meet their needs.In addition, the open platform integrates all kinds of financial institutions and intermediary organizations, and can provide users with a variety of financial services, which are not only diversified, but also personalized, which are packaged one-stop services, and which can also be personalized selection and combination by users according to their needs.

When providing services to users, financial institutions rely on big data credit investigation to make up for the defects of imperfect credit investigation system in China. In risk control, they have more data dimensions, more accurate decision engine judgment and better anti-fraud effect.On the other hand, Internet technology has improved the protection of user information and capital security.